How Much Does a Land Survey Cost? Nationwide Prices (2026)

You found an affordable piece of land, maybe through a tax deed auction or an off-market deal. Before you close, there’s one critical step most buyers overlook: getting a survey. Understanding how much does a land survey cost helps you budget properly and avoid surprises that eat into your investment returns.

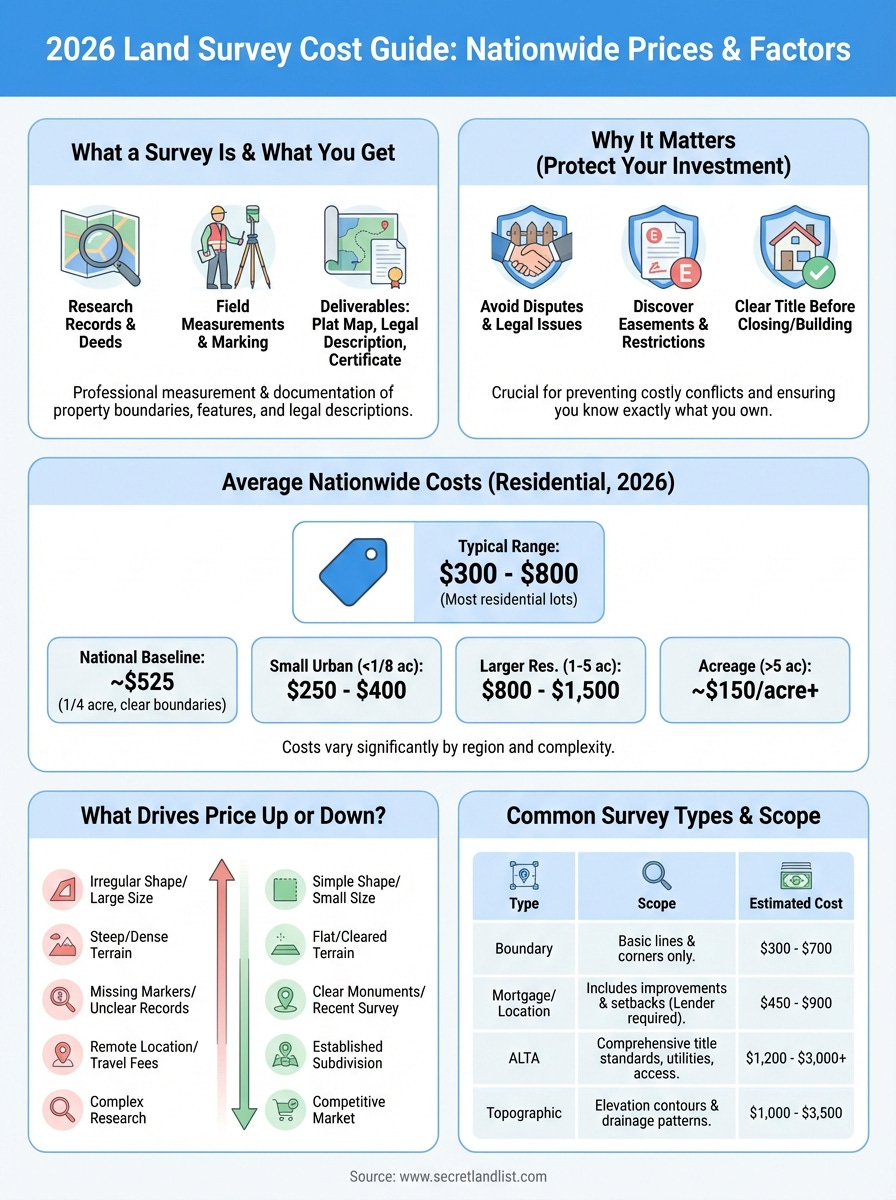

Survey costs vary widely, from $200 for a simple boundary check to $5,000 or more for complex commercial properties. The final price depends on factors like property size, terrain, location, and the type of survey you actually need. Rural acreage in Texas won’t cost the same as a dense subdivision lot in New Jersey.

At Secret Land List, we help readers find affordable land opportunities across the country. But finding a deal is only part of the equation, knowing your true acquisition costs matters just as much. A survey protects you from boundary disputes, encroachments, and title issues that can turn a bargain into a headache.

This guide breaks down nationwide survey pricing for 2026, explains what drives those costs up or down, and shows you when you can skip the expense versus when it’s non-negotiable. Whether you’re buying your first half-acre lot or scaling a land portfolio, you’ll walk away knowing exactly what to budget.

What a land survey is and what you get

A land survey is a professional measurement and documentation of your property’s exact boundaries, physical features, and any structures or encroachments. A licensed surveyor uses specialized equipment like GPS units, total stations, and theodolites to map your land down to fractions of an inch. You’re not just buying a sketch, you’re getting a legal document that defines where your property starts and ends.

The surveying process and timeline

When you hire a surveyor, they start by researching existing property records, deeds, and previous surveys at the county recorder’s office. This historical research identifies your property’s legal description and any easements or restrictions. The surveyor then visits your property to physically measure and mark boundaries with metal stakes, iron pins, or wooden hubs painted bright colors so you can find them later.

Most residential surveys take two to five business days from start to finish, though dense vegetation, bad weather, or disputed boundaries can stretch timelines to two weeks or more. Rural properties with unclear deed descriptions or missing corner markers require extra research time, which directly impacts how much does a land survey cost. Your surveyor coordinates the field work when conditions allow accurate measurements, not just when it fits your schedule.

What documents and maps you receive

Your completed survey package includes a drawn plat or map showing your property’s shape, dimensions, and location of all boundaries. This document displays existing structures, fences, driveways, utilities, and easements with precise measurements from property lines. You’ll see notations for any encroachments, like a neighbor’s shed sitting three feet over your boundary or a utility easement running through your backyard.

The surveyor also provides a written legal description that matches or updates what’s in your deed, using metes and bounds or lot-and-block format depending on your location. You receive a signed and sealed certificate from the licensed surveyor, which carries legal weight in court if boundary disputes arise. Many surveyors now deliver digital PDF files alongside paper copies, making it easy to share with your title company, lender, or attorney during closing.

A professional survey protects your investment by documenting exactly what you’re buying before money changes hands.

Common survey types and their scope

Boundary surveys are the most basic type, establishing only your property lines and corners without detailed topography or improvement locations. These work well for simple transactions where you just need to confirm acreage and perimeter dimensions. Mortgage or location surveys go further by showing all buildings, driveways, and major improvements relative to setback lines, which most lenders require before approving financing.

ALTA surveys meet stringent standards set by the American Land Title Association and include everything in a location survey plus utility locations, access rights, and zoning classifications. Developers and commercial buyers need these comprehensive surveys. Topographic surveys add elevation contours and drainage patterns, critical for construction planning but overkill for most vacant land purchases where you won’t be building immediately.

Why a land survey matters before you buy or build

A survey reveals hidden problems that can derail your plans or cost thousands to fix after closing. You might discover that your property lines don’t match what the seller claimed, or that a utility easement runs right through your ideal building site. These issues surface when a professional surveyor documents the truth on the ground, not just what’s written in an outdated deed.

Avoiding boundary disputes and legal problems

Boundary disputes rank among the most expensive and emotionally draining conflicts between neighbors. Without a current survey, you rely on old fence lines or verbal descriptions that may be completely wrong by several feet or more. A surveyor’s professionally marked corners and legal documentation give you solid proof if a neighbor challenges where your property ends.

Legal problems multiply when you build a structure that accidentally crosses onto someone else’s land. You could face a court-ordered removal of your new garage or shed, plus attorney fees and damages. Title insurance won’t cover boundary issues that a survey would have caught before purchase, leaving you holding the bill for mistakes you didn’t make.

A survey protects you from inheriting the previous owner’s boundary mistakes or assumptions.

Discovering easements and restrictions

Your property deed might contain recorded easements for utilities, road access, or drainage that limit where you can build or fence. A survey maps these restrictions with exact locations, so you know which parts of your land you actually control. Some easements give power companies or neighbors permanent access rights across your property, effectively creating no-build zones you need to respect.

Setback requirements and building envelopes also appear on many surveys, showing you exactly where structures are legally permitted. This information becomes critical before you invest in architectural plans or grading work. Understanding how much does a land survey cost becomes less relevant when you consider the expense of redesigning plans because you didn’t know about a 20-foot utility easement running through your property.

When you can skip the survey

You can sometimes skip a full survey on simple residential lots in well-established subdivisions where recent surveys exist and no boundary questions arise. If you’re buying raw land for long-term holding without immediate building plans, you might delay the survey expense. However, most lenders require surveys before closing, and skipping this step when boundary markers are missing or property lines seem unclear almost always backfires.

Average land survey costs in 2026

Understanding how much does a land survey cost starts with knowing the national averages that surveyors charge across different property types and survey complexities. Most residential surveys fall between $300 and $800 for standard single-family lots in subdivisions, while rural acreage and complex properties push costs significantly higher. These prices reflect current labor rates, equipment costs, and professional liability insurance that surveyors carry.

National baseline and typical ranges

The median residential survey in 2026 costs approximately $525 for a quarter-acre lot with clear boundaries in an established neighborhood. This baseline assumes flat terrain, accessible property corners, and no major complications like disputed lines or dense vegetation. You’ll pay toward the lower end of this range in competitive markets with multiple surveyors, while rural areas with fewer professionals charge premium rates.

Small urban lots under one-eighth acre sometimes cost as little as $250 to $400 because surveyors can complete the work in a few hours. Larger residential properties from one to five acres typically run $800 to $1,500 depending on shape complexity and boundary marker visibility. Properties exceeding five acres often see per-acre pricing that starts around $150 per acre but drops as total acreage increases.

Survey costs represent a small fraction of your total land investment but prevent problems worth thousands in legal fees.

Costs by survey type

Boundary surveys remain the most affordable option at $300 to $700 for typical residential lots, covering only property line identification and corner marking. Mortgage location surveys that lenders require add building locations and setback measurements, raising prices to $450 to $900 for the same property size. ALTA surveys meeting title company standards cost $1,200 to $3,000 or more because they include utility research, easement verification, and detailed improvement documentation.

Topographic surveys measuring elevation changes and drainage patterns run $1,000 to $3,500 for residential properties, with commercial sites exceeding $5,000 regularly. Subdivision surveys dividing larger parcels into multiple lots start around $2,500 and scale with complexity. Construction staking for builders adds another $500 to $1,500 on top of initial survey costs.

Regional price differences

Surveyors in California, New York, and Massachusetts charge 30 to 50 percent above national averages due to higher business costs and stricter licensing requirements. Rural states like Montana, Wyoming, and Mississippi see lower hourly rates but longer travel times that offset savings. Urban markets with strong competition like Texas and Florida offer competitive pricing, while remote properties anywhere add travel fees of $100 to $300 to your final bill.

What drives the price up or down

Understanding what influences survey pricing helps you predict your actual costs before requesting quotes. Several factors combine to determine how much does a land survey cost, with some variables you can control and others fixed by your property’s characteristics. Surveyors price their services based on time requirements, difficulty level, and professional liability exposure.

Property size and shape

Larger properties cost more because surveyors need to measure and mark more boundary corners along extended perimeter lines. A rectangular five-acre parcel typically runs $1,200 to $2,000, while an irregular 20-acre tract with multiple angles and curves might reach $3,000 to $5,000 or higher. Surveyors charge more for odd-shaped properties that require extra corner calculations and field measurements.

Narrow, deep lots take longer to survey than square parcels of equal area because access difficulties and sight line challenges slow field work. Properties with missing or damaged corner markers add research and recovery time that directly increases your final bill. Your surveyor may need to trace historical records backward through multiple previous surveys to establish accurate boundaries.

Properties with clear monuments and recent surveys typically cost 20 to 40 percent less than those requiring extensive research.

Terrain and accessibility

Steep slopes, dense vegetation, and rocky ground force surveyors to work slower and use specialized equipment that increases labor costs. Flat, cleared land allows faster measurements and simpler setups, keeping prices at the lower end of typical ranges. Swampy areas, creek crossings, and heavy brush require extra time to traverse and clear sight lines between survey points.

Remote properties without road access add travel time and equipment transport costs that many surveyors bill separately. Winter weather in northern states limits surveying seasons and creates scheduling backlogs that can push prices higher during peak spring months.

Survey complexity and research time

Properties with disputed boundaries, conflicting deeds, or missing historical records require extensive courthouse research that adds billable hours. Each previous survey the surveyor must review, verify, or reconcile increases the total time investment. Easements, rights of way, and zoning verification for ALTA surveys demand additional research and documentation that basic boundary surveys skip entirely.

How to estimate your cost and hire a surveyor

You need accurate cost estimates before committing to any surveyor, and getting those numbers requires providing specific details about your property and survey needs. Most surveyors offer free initial consultations where they assess your situation and provide written quotes based on property characteristics. The more information you share upfront, the more reliable your estimate becomes.

Getting accurate quotes from multiple surveyors

Contact at least three licensed surveyors in your area with your property address, parcel number, and deed description to receive comparable estimates. Explain exactly what you need, whether it’s a basic boundary survey for fence placement or a comprehensive ALTA survey for commercial financing. Detailed requests produce more accurate quotes than vague inquiries about general pricing.

Ask each surveyor to break down their quote into labor, research, and travel components so you understand where your money goes. Request information about their timeline, typical turnaround from field work to final documents, and what deliverables you’ll receive. Some surveyors charge flat rates for standard residential work while others bill hourly, which affects how much does a land survey cost when complications arise during the project.

Getting multiple detailed quotes helps you identify fair market pricing and avoid surveyors who underbid then add surprise charges later.

Checking credentials and reviews

Verify that any surveyor you consider holds a current professional license in your state through your state’s licensing board website. Most states maintain online databases where you can check license status, disciplinary actions, and expiration dates. Licensed surveyors carry professional liability insurance that protects you if errors in their work cause financial losses.

Look for online reviews on Google and the Better Business Bureau to identify consistent service patterns and potential red flags like missed deadlines or billing disputes. Local real estate attorneys and title companies often maintain lists of reliable surveyors they trust for client referrals. Professional associations like the National Society of Professional Surveyors indicate surveyors who invest in continuing education and industry standards.

Ask potential surveyors for references from recent similar projects in your area, particularly if your property presents unusual challenges. Their willingness to provide contacts and discuss past work demonstrates confidence in their service quality.

Next steps for your land purchase

Now you know how much does a land survey cost and what drives those prices acr

oss different property types and regions. Budget $300 to $800 for most residential lots, with rural acreage and complex surveys requiring more investment due to extensive research and challenging terrain. Request detailed quotes from three licensed surveyors before making your decision, and verify their credentials through your state licensing board to ensure professional protection.

Your survey protects you from boundary disputes, hidden easements, and title problems that derail land investments. Schedule the survey before closing so you have time to address any issues the surveyor uncovers. Most problems become expensive or impossible to fix after you own the property.

Finding affordable land opportunities is just the first step in building wealth through real estate. Secret Land List delivers curated off-market deals and tax deed opportunities directly to your inbox, helping you build a land portfolio without breaking your budget on retail listings.

Solid breakdown of survey pricing variables. The distinction between skippable and non-negotiable surveys is particularly useful for anyone scaling a land portfolio. What often gets overlooked is how much the "missing corner markers" variable can swing costs, somtimes doubling estimates when surveyors have to reconstruct historicl boundaries. The regional pricing differentials make sense given licensing complexity, but that travel fee surcharge on remote properties is defintely somethng to budget for upfront.